555-555-5555

mymail@mailservice.com

Creating Hope and Opportunity for Alabama Students' Education (CHOOSE) Act of 2024

Alabama families are now eligible for up to $7,000 a year towards educational expenses.

Find out how the CHOOSE Act Can Benefit Your Family

Contact Us

Your request for more information about the CHOOSE Act has been received, keep an eye on your inbox for details on who is eligible and how it can benefit your family.

Please try again later.

Thanks to the CHOOSE Act, Alabama families can now choose the environment that is right for each of their children regardless of their zip code.

What is the Choose Act?

The Choose Act makes refundable income tax credits called education savings accounts (ESAs) available to support every K-12 student in AL. This program will be established and implemented by the Alabama Department of Revenue, who will create the framework and funding process for the ESAs. Eligible families may use ESA funds to cover tuition, fees, and other qualified expenses at approved education service providers.

Who is eligible for the CHOOSE Act?

Year 1: 2025-2026

- The first 500 ESAs go to students with special needs students, students of active-duty service members in priority schools get ESAs and families with income up to 300% of the federal poverty level.

Year 2: 2026-2027

- The first 500 ESAs go to students with special needs.

- Then, students and siblings of students who got ESAs last year, students of active-duty service members in priority schools, and students from families with income up to 300% of the federal poverty level.

Year 3: 2027-2028 and beyond

- The first 500 ESAs go to students with special needs.

- Next, students and siblings of students who got ESAs the previous year(s), students of active-duty service members in priority schools, and all other students, regardless of income.

An “eligible student” for the credit is:

- A child aged five to 19 years residing in Alabama who hasn’t finished high school.

- Or a child aged five to 21 years residing in Alabama who qualifies for services under the Individuals with Disabilities Education Act (IDEA) or Section 504 of the Rehabilitation Act of 1973.

However, the term doesn’t include:

- A student receiving scholarship funds or tax credits under the Alabama Accountability Act.

- A child enrolled in a private school that isn’t a participating school (participating schools are accredited public schools and accredited private schools).

- A child who isn’t lawfully present in the United States.

How much money can I receive with the CHOOSE ACT?

Starting from the 2025-2026 Academic Year, ESAs will be available in these amounts:

- Up to $7,000 per participating student enrolled in a participating school.

- Up to $2,000 per participating student not enrolled in a participating school. However, this amount is capped at $4,000 for students in individual or group homeschool programs, co-ops, non-participating schools, or similar programs.

How will funds for the CHOOSE Act be distributed?

The CHOOSE Act sets up a system of refundable income tax credits and is managed by the Department of Revenue, aimed at parents of eligible students. These credits are meant to help cover the expenses of qualifying education. The Department of Revenue will establish education ESAs where the credit funds will be deposited. Participating parents can then use these funds to pay for approved educational expenses.

What can families spend the money on?

- Tuition and fees at a participating school

- Textbooks

- Fees for after-school or summer education programs at a participating school

- Private Tutoring

- Curricula

- Tuition for a nonpublic online learning program

- Educational software

- Costs for college admission tests and AP exams

- Education services for students with disabilities from a licensed or accredited practitioner

- Contracted services provided by a public school district

How does a student apply for access to the CHOOSE Act Funding?

According to the text of the

CHOOSE Act, the Department of Revenue is establishing a process for enrollment of the program. Both parents and schools will be required to agree to the terms and rules as outlined in the legislation.

Do I need to submit a renewal application for the CHOOSE Act?

Based on the text of the CHOOSE Act, there is no explicit requirement in the CHOOSE Act for submitting a renewal application for participation. The Alabama Department of Revenue mentions “participating students previously awarded in the prior academic year,” suggesting that students who received the credit in the previous year may continue to receive it without the need for a renewal application. However, since updates and clarifications are still forthcoming, make sure to stay informed about any additional information released regarding renewal requirements for the tax credit.

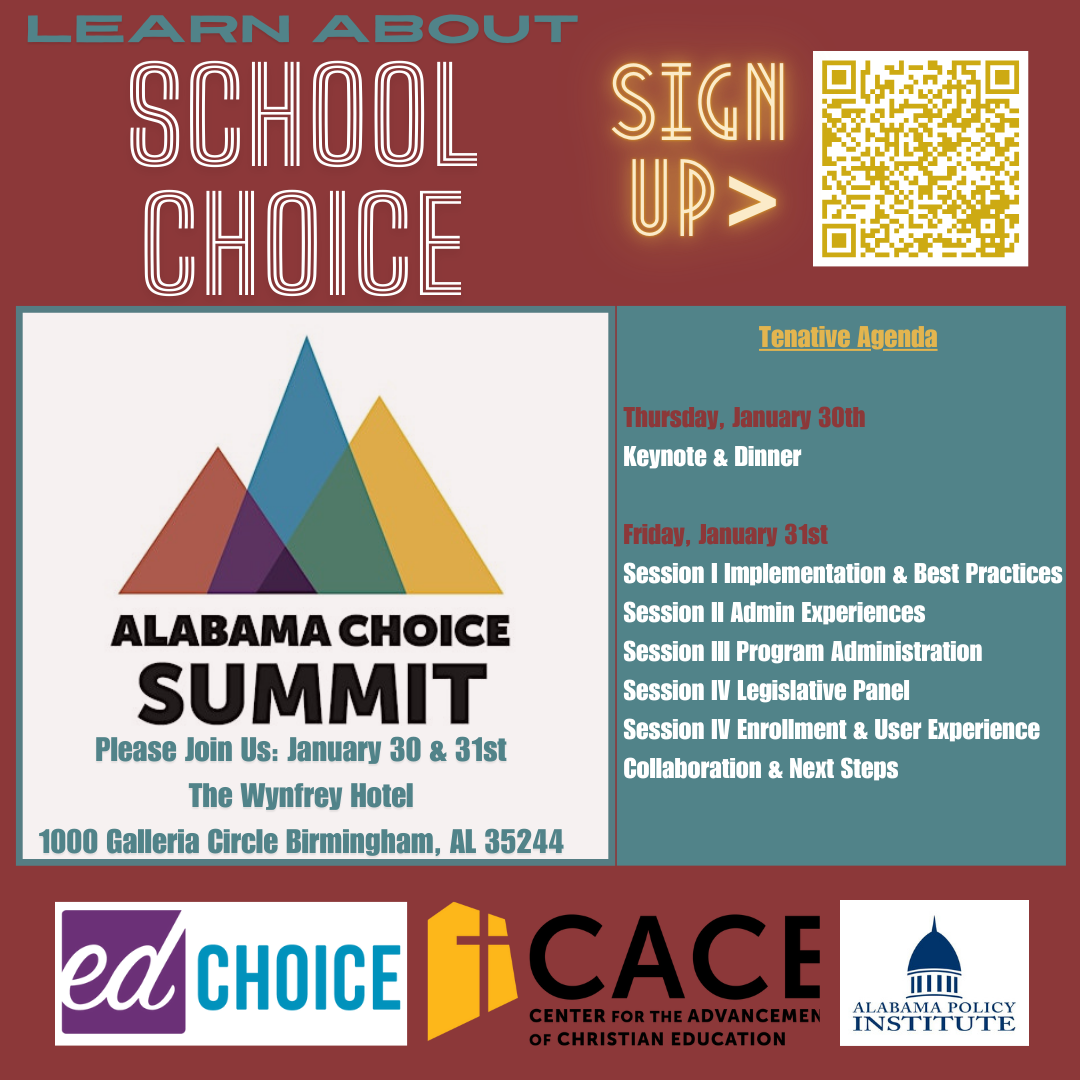

Learn more about Alabama's CHOOSE Act.

The CHOOSE ACT Website is UP!

School applications are online now!

Parent applications will be available on January 2nd.

Click below!

Click above to explore the history of school choice